medicinetizer.ru

Prices

Do I Need To Purchase Car Rental Insurance

Your auto policy should be sufficient as long as you have confirmed the coverage carries over while renting. Be certain to do a full walk. If you plan to rent a vehicle frequently, your best bargain is to purchase a non-owner auto liability insurance policy from us. Rental car insurance is not required by law and may already be covered by your personal car insurance. If you want complete peace of mind, get the rental car insurance. If you opt out of the additional rental car insurance make sure you understand that there are. In most cases, your existing policy will apply to a rental car, so you likely won't need to purchase additional coverage. While the rental car companies themselves have to buy liability insurance to register their cars, most companies get only enough coverage to meet the required. I have one motor vehicle policy that insures my five automobiles. Do I have rental vehicle coverage on my policy? No, rental vehicle coverage is required to. However, there's one type of insurance you should get: a collision damage waiver, which covers costs associated with rental car damage or theft. It's smart to. Generally yes the policy will cover you, however what your insurance policy doesn't cover is the cost per day of the rental while it's off the. Your auto policy should be sufficient as long as you have confirmed the coverage carries over while renting. Be certain to do a full walk. If you plan to rent a vehicle frequently, your best bargain is to purchase a non-owner auto liability insurance policy from us. Rental car insurance is not required by law and may already be covered by your personal car insurance. If you want complete peace of mind, get the rental car insurance. If you opt out of the additional rental car insurance make sure you understand that there are. In most cases, your existing policy will apply to a rental car, so you likely won't need to purchase additional coverage. While the rental car companies themselves have to buy liability insurance to register their cars, most companies get only enough coverage to meet the required. I have one motor vehicle policy that insures my five automobiles. Do I have rental vehicle coverage on my policy? No, rental vehicle coverage is required to. However, there's one type of insurance you should get: a collision damage waiver, which covers costs associated with rental car damage or theft. It's smart to. Generally yes the policy will cover you, however what your insurance policy doesn't cover is the cost per day of the rental while it's off the.

No, you do not need insurance to rent a car because rental companies have their own insurance. Rental car companies usually provide minimum liability coverage. Personal Auto Insurance Coverage. The coverage that you have for your own car generally applies to rental cars, as long as you aren't using the car for business. You'll usually want to purchase any rental car insurance coverage that is available to you from the rental company. Rental car insurance, sometimes called rental car coverage, is a type of protection that is offered at the time of rental to cover you when you rent a vehicle. In most instances, rental car insurance overlaps with your personal auto insurance policy and you won't need to pay for duplicate coverage. The truth is, your own auto policy may already cover your rental. Buying supplemental insurance from the rental company— can add approximately $15 to $30 per. No, you do not need your own personal car insurance in order to rent a car from Enterprise. We offer several different types of car rental insurance plans and. When renting a car, the rental company will typically ask if you'd like to purchase insurance coverage for the vehicle. It's at this point when you have to ask. No, you do not need insurance to rent a car because rental companies have their own insurance. Rental car companies usually provide minimum liability coverage. You are not required to purchase car rental insurance when you rent from Enterprise. If you are interested in purchasing rental car insurance and additional. How does credit card car rental insurance work? First and foremost, if you want to be covered by your credit card's car rental insurance, you must pay for the. Do you need insurance to rent a car? No, you don't need to have insurance because rental cars are already insured. That said, some form of rental insurance is. How does credit card car rental insurance work? First and foremost, if you want to be covered by your credit card's car rental insurance, you must pay for the. Just note that comprehensive and collision insurance are optional in a personal auto policy. If you don't have them, you may want to consider purchasing the. Does car insurance cover rental cars? If you drive an insured car at home, you may not have to buy car rental insurance. “In most cases, whatever auto. Renting without auto insurance. While you don't need to have your own insurance policy to rent a car, it's a smart idea to purchase rental car insurance when. No. Rental car insurance isn't required to rent a car. However, Costco Travel highly recommends it for your protection. Here are some of the options to get. You will need to meet minimum standards for liability, and you can rest assured that the rental insurance will cover you in the event of an accident. You can. Coverages Offered By Rental Car Company: · 1. Loss Damage Waiver / Collision Damage Waiver · 2. Supplemental Liability Insurance · 3. Personal Accident Coverage · 4.

Bank With Lowest Interest Rate For Car Loan

An interest rate is the percentage banks charge you for borrowing money. The best interest rate on a car loan is the lowest one you can get, but. Online Lenders · Quick decisions and loan funding; Enables cash purchasing for a car ; MyAutoLoans · Fast approvals; Ability to compare offers from up to four. Compare car loans from multiple lenders to find your best rate and learn what you need to know about financing before you apply. Apply for a new or used car loan with car financing from PNC Bank. Use our auto loan calculator to check current rates. Even if you're not with us. Work out your car loan now · Get a lower rate of % when you buy an electric car The interest rate on your car loan never. Drive away with competitive rates and flexible terms on a new or used car, truck or SUV. U.S. Bank offers rates as low as % on loans of at least $40, The three main factors in getting the best rate for an auto loan are your credit score, finances and the lender. You could save on interest by refinancing your current auto loan to a lower rate at Alliant. car loan anytime, anywhere with Alliant's online banking and. What banks have to lowest interest rates for car loans!? I am planning to buy my first car in September. I have a $10, down payment ready to. An interest rate is the percentage banks charge you for borrowing money. The best interest rate on a car loan is the lowest one you can get, but. Online Lenders · Quick decisions and loan funding; Enables cash purchasing for a car ; MyAutoLoans · Fast approvals; Ability to compare offers from up to four. Compare car loans from multiple lenders to find your best rate and learn what you need to know about financing before you apply. Apply for a new or used car loan with car financing from PNC Bank. Use our auto loan calculator to check current rates. Even if you're not with us. Work out your car loan now · Get a lower rate of % when you buy an electric car The interest rate on your car loan never. Drive away with competitive rates and flexible terms on a new or used car, truck or SUV. U.S. Bank offers rates as low as % on loans of at least $40, The three main factors in getting the best rate for an auto loan are your credit score, finances and the lender. You could save on interest by refinancing your current auto loan to a lower rate at Alliant. car loan anytime, anywhere with Alliant's online banking and. What banks have to lowest interest rates for car loans!? I am planning to buy my first car in September. I have a $10, down payment ready to.

Auto Loans & Refinancing. Get a low-interest car loan that fits your budget or refinance an existing auto loan for a potentially better rate and a lower payment. finance a car: Is this the lowest interest rate I can get without extending the term? What's the total cost of this car? (Don't forget to include your loan. Vehicle Financing Options for Cars to Boats and Everything In Between. New Car Loans. • Low-Interest Rates: Secure one of the lowest rates in the. Car Loan Interest Rate Comparison ; Public Bank Aitab Hire Purchase-i, % - % p.a., New / Used, 7 - 9 years ; Hong Leong Auto Loan, % - % p.a. Best from a big bank: Capital One Auto Finance · Best from a credit union: PenFed Auto Loans · Best for rate shopping: myAutoloan · Best for a simple online. However, various points must be considered before buying a used car on loan. It is important that you compare the interest rates offered by various banks and. Auto Loan Interest Rates for + Model Year Vehicles · 36 Months, %, $ 48 Months, %, $ 60 Months, %, $ 72 Months, %. Compare car loans from multiple lenders to find the best rate · Navy Federal Credit Union: Best car loan for those with military connections · Southeast Financial. Refinancing options are also available to lower your interest rates and reduce current payments. Buy a Car. Buy a New or Used Car. Have. Auto Loans and Rates · Special Interest Rate Discount! · Car loan rates as low as % APR* · 5-Year Auto Loan · Apply for a Car Loan. And you won't even have to negotiate to get a great deal. Auto financing that offers lower interest rates and flexible terms. New Auto Loan Rates. The average car loan interest rate in is around 4% for new cars and 8% for used cars based on the Experian data above. A good interest rate will be at or. Consumer credit reporting company Experian releases average auto loan interest rates in its quarterly Automotive Finance Market report. In the second quarter of. Compare a lower interest rate to a lower balance (via a cash back incentive). Amount Paid. Low Rate. Used Auto Loans. Discounted competitive rates starting at. % APR*. Refinancing. Refinance your current auto loan at a lower rate and save! , Members. After applying, the bank or credit union will check your credit history and let you know if you qualify for a lower interest rate. After approval, the bank or. Car Loan Rates · First National Bank • Used Car Loan • 72 Months · LightStream • Used Car Loan • 72 Months · Popular Bank • Used Car Loan • 72 Months · WSFS Bank •. Since they know you and have a relationship with you, they may be willing and able to offer you a lower interest rate than a dealership. The bank may even offer. Need to refinance your vehicle? We can help. If you want to lower your monthly payment — either with a lower interest rate or extended term — we offer. Compare a lower interest rate to a lower balance (via a cash back incentive). Amount Paid. Low Rate.

Refinance My Car Through Capital One

It's important to understand that refinancing may lead to paying more interest over the life your loan. If you refinance with a lower interest rate the savings. Standout benefits: Capital One makes the car buying process convenient. Using the bank's online Auto Navigator tool, you can browse used and new cars from. "Unbelievably easy. Couldn't be happier." An auto loan refinance from Capital One could help you save with an easy online process. Do you have a car loan that you want to refinance? Save money and reduce your payments by refinancing your current auto your loan with Educators. We only refinance standard auto loans with only one lienholder on the vehicle title for the loan you wish to refinance. We do not refinance unsecured loans or. Some lenders won't even consider refinancing an older car. Capital One, for example, only refinances loans for vehicles that are seven years old or newer. If. Today I receive a letter in the mail from Capital One, pre-approving me for %, with multiple loan options. They are as follows: $/month. But with Capital One the minimum is $4,, so it's a good option if you're hoping to buy an older, inexpensive used car. Offers refinancing: Not all lenders. Drivers typically save an average of $* per month, adding up to $* annually, when they refinance their Capital One loan. It's important to understand that refinancing may lead to paying more interest over the life your loan. If you refinance with a lower interest rate the savings. Standout benefits: Capital One makes the car buying process convenient. Using the bank's online Auto Navigator tool, you can browse used and new cars from. "Unbelievably easy. Couldn't be happier." An auto loan refinance from Capital One could help you save with an easy online process. Do you have a car loan that you want to refinance? Save money and reduce your payments by refinancing your current auto your loan with Educators. We only refinance standard auto loans with only one lienholder on the vehicle title for the loan you wish to refinance. We do not refinance unsecured loans or. Some lenders won't even consider refinancing an older car. Capital One, for example, only refinances loans for vehicles that are seven years old or newer. If. Today I receive a letter in the mail from Capital One, pre-approving me for %, with multiple loan options. They are as follows: $/month. But with Capital One the minimum is $4,, so it's a good option if you're hoping to buy an older, inexpensive used car. Offers refinancing: Not all lenders. Drivers typically save an average of $* per month, adding up to $* annually, when they refinance their Capital One loan.

Why should I refinance my car? Refinancing your auto loan could help you lower your monthly payment by providing a better interest rate or changing the length. If you have a low credit score and refinance a car loan, one major benefit is the potential to lower your monthly payments. If you have several more years left. Paying off your existing car loan and refinancing it into a new one could help you save money by scoring a lower interest rate. Apply today. Do not use capitol one auto finance they are heartless soulless m#@## F *&#@. my mom passes away in april in order to get the pink slip to her car we had to. I've refinanced with capital one before, it was a straight forward experience. If you're saving money there's no downside. Start saving by refinancing your auto loan. You could lower your car payment, annual percentage rate (APR) or both. Check for savings easily with no impact to. If you are financing with one of Tesla's indirect partners, the payment must How do I finance my vehicle with a third-party? You can choose to. Capital One Auto Finance provides financing for new and used vehicles purchased from participating dealers listed on our Dealer Locator. Participating dealers. You can only refinance your vehicle with Ally if your current financing is through another lender, and if your vehicle isn't financed in Nevada, Vermont, or the. After you get the actual VIN of the car you are going to purchase, the dealer will print out or send to Capital One a Buyers Order with the line. Yes, Capital One offers several affordable refinancing options for auto loans. Some of the reasons why Capital One Auto Refinance is popular with customers. Capital One Auto Finance completes a soft credit inquiry, and then lets you know within minutes if you prequalify. From there, you can use Auto Navigator to. Capital One Auto Finance provides financing for new and used vehicles purchased from participating dealers listed on our Dealer Locator. Participating dealers. Use our auto refinance calculator to discover how you may be able to lower your monthly car payments. Neil (NEI) in customer service was amazing. I felt like my heart dropped into my stomach before I spoke with him. I needed help deferring payments since I. Capital One auto refinance offers a fixed APR car loan refinancing product that ranges from % APR up to % APR. Does Capital One auto refinance charge an. Capital One offers borrowers the option of purchasing GAP coverage, or Guaranteed Auto Protection. With GAP, car owners will have excess finances to cover the. Ah, paperwork, the bane of our existence. When applying for auto refinancing with Capital One, you`ll typically need to provide proof of income, vehicle. After you're pre-qualified, you'll be able to see your real rate and monthly payment while you shop for cars. That means no more guessing if a car fits your. Can I refinance my vehicle with Chase? opens in the same window. No, Chase Online at medicinetizer.ru, at one of our dealerships with the Chase dealer.

Best Credit Card For Llc

Best business credit cards of September ; Ink Business Preferred® Credit Card · · Earn , bonus points ; Ink Business Cash® Credit Card · Find the best business credit card from Chase. Get rewarded on business expenses with sign up bonus offers, cashback rewards, airline miles, and more on all. Do some research to find the best card for your needs. Many offer bonus points or rewards for spending in certain categories or during specific time periods. Yes, many limited liability companies (LLCs) have business credit cards. To apply for and get a credit card with an LLC, you must be an owner, officer, or. There are so many great reasons to carry a Truist Visa® card. · Earn a rewards boost. · Empower your employees. · Manage cardholder spend. · Contactless payments. Choose the best business credit card for your business. Fifth Third Simply Google Play and Android are registered trademarks of Google LLC. Card Agreements. The best business credit card for a new LLC is the Capital One Spark Classic for Business because it offers solid rewards, has a $0 annual fee, and accepts. The Plum Card® from American Express: Financial Flexibility and Early Payment Rewards The Plum Card can be a great option for businesses with unpredictable. The right business credit card can help you book travel and earn rewards for your spending. Compare the top business cards today. Best business credit cards of September ; Ink Business Preferred® Credit Card · · Earn , bonus points ; Ink Business Cash® Credit Card · Find the best business credit card from Chase. Get rewarded on business expenses with sign up bonus offers, cashback rewards, airline miles, and more on all. Do some research to find the best card for your needs. Many offer bonus points or rewards for spending in certain categories or during specific time periods. Yes, many limited liability companies (LLCs) have business credit cards. To apply for and get a credit card with an LLC, you must be an owner, officer, or. There are so many great reasons to carry a Truist Visa® card. · Earn a rewards boost. · Empower your employees. · Manage cardholder spend. · Contactless payments. Choose the best business credit card for your business. Fifth Third Simply Google Play and Android are registered trademarks of Google LLC. Card Agreements. The best business credit card for a new LLC is the Capital One Spark Classic for Business because it offers solid rewards, has a $0 annual fee, and accepts. The Plum Card® from American Express: Financial Flexibility and Early Payment Rewards The Plum Card can be a great option for businesses with unpredictable. The right business credit card can help you book travel and earn rewards for your spending. Compare the top business cards today.

Find the best business credit card from Chase. Get rewarded on business expenses with sign up bonus offers, cashback rewards, airline miles, and more on all. Ink Business Premier® Credit Card: Best feature: $1, cash back sign-up bonus. The Blue Business® Plus Credit Card from American Express: Best feature: Best Card LLC is a registered ISO of Wells Fargo Bank, N.A., Concord, CA. Best Card LLC is a registered ISO of Wells Fargo Bank, N.A., Concord. Good afternoon BP family, Home Depot offers a 24 month 0% financing card, but it is only available to “consumers”. I have a project within my real e. Best business credit cards for LLCs · Best for welcome bonus: Ink Business Unlimited® Credit Card · Best for no annual fee: The Blue Business® Plus Credit Card. The Business Gold Card, Now Available in White Gold · Let Your Business Power Your Stay with Enhanced Hilton Honors Benefits · Find the Best Card for Your. American Express Blue Business Cash™: Overall best business credit card for LLCs with everyday expenses and expanded buying power; U.S. Bank Business Triple. Is Brex the best corporate credit card for startups and growing businesses? Are Brex cards good business credit cards for an LLC? How can I use the Brex card? If you're a sole proprietor or a single-person LLC, it's 1. Annual revenue. If Most business credit card issuers want a good to excellent credit score. Our team of experts evaluates hundreds of credit cards and analyzes thousands of data points to help you find the best card for your situation. Chase is the best for this, but your earn rate would only be x from the Ink Unlimited, giving you K points for 75K spend. Amex is the. That said, you still need good personal credit in order to be deemed credit-worthy for good business credit cards. The process of building. Here, I'll lay out my favorite business credit cards for new LLCs. You'll see a summary of each offer (why I like it) and how long your business must be in. The Business Gold Card, Now Available in White Gold · Let Your Business Power Your Stay with Enhanced Hilton Honors Benefits · Find the Best Card for Your. $0 annual fee and 0% introductory APR for the first 12 months. credit icon Good credit. Everyday Rewards. Unlimited % cash back on every purchase. Use our small business credit card comparison tool to find the best card for you and your business. See more card comparison information. Other cards such as the Amex Blue Business Plus card might offer 2x points, but the bonus rewards are capped at $50, per year. With the Ink Business. Small Business Credit Cards ; Business Advantage Customized Cash Rewards credit card. Online offer: $ statement credit bonus · 0% for 9 billing cycles. Earn rewards for your business purchases, including supplies and equipment, with a Wells Fargo business credit card. Redeem rewards to eligible accounts.

Best Software For Investing

Where NinjaTrader really stands out though, is with its trading simulator. This feature allows investors to practice trading strategies and get a sense of the. One such app is called Magnifi, which uses ChatGPT and other AI tools to provide real-time investment advice. Magnifi acts like something of an AI-powered. Top Investment Portfolio Management Software. Choose the right Investment Portfolio Management Software using real-time, up-to-date product reviews from Welcome to E*TRADE. No matter your level of experience, we help simplify investing and trading. Our award-winning app puts everything you need in the palm. Best Portfolio Management Software Tools · Quicken Premier · Sharesight · Empower Personal Dashboard · SigFig · Kubera · Morningstar Investor · Fidelity Full. Download Investing - Best Software & Apps · Quotex - Online Investing Platform · Groww: Stocks Mutual Fund · MetaTrader 4 · CASHFLOW - The Investing Game. Moka - Best for reinvesting spare change · Wealthsimple Invest - Best for robo-advisor investing · Wealthica - Best for comprehensive portfolio tracking · Passiv -. medicinetizer.ru offers a set of financial tools covering a wide variety of global and local financial instruments. A one-stop-shop for traders and investors. 7 Best Investment Apps for Beginners · SoFi Invest. · Investr. · Betterment. · Robinhood. · Acorns. · Ellevest. · Suma Wealth. Where NinjaTrader really stands out though, is with its trading simulator. This feature allows investors to practice trading strategies and get a sense of the. One such app is called Magnifi, which uses ChatGPT and other AI tools to provide real-time investment advice. Magnifi acts like something of an AI-powered. Top Investment Portfolio Management Software. Choose the right Investment Portfolio Management Software using real-time, up-to-date product reviews from Welcome to E*TRADE. No matter your level of experience, we help simplify investing and trading. Our award-winning app puts everything you need in the palm. Best Portfolio Management Software Tools · Quicken Premier · Sharesight · Empower Personal Dashboard · SigFig · Kubera · Morningstar Investor · Fidelity Full. Download Investing - Best Software & Apps · Quotex - Online Investing Platform · Groww: Stocks Mutual Fund · MetaTrader 4 · CASHFLOW - The Investing Game. Moka - Best for reinvesting spare change · Wealthsimple Invest - Best for robo-advisor investing · Wealthica - Best for comprehensive portfolio tracking · Passiv -. medicinetizer.ru offers a set of financial tools covering a wide variety of global and local financial instruments. A one-stop-shop for traders and investors. 7 Best Investment Apps for Beginners · SoFi Invest. · Investr. · Betterment. · Robinhood. · Acorns. · Ellevest. · Suma Wealth.

Focused on examining evolving trends in the modern software development stack and analyzing the companies that power them for investment. The Tegus platform unites insights from credible experts with the best A single software license to drive value and consolidated cost. Make better. Connected Investors is an all-in-one real estate investment software to help you grow your business. Morningstar is an investment research company offering mutual fund, ETF, and stock analysis, ratings, and data, and portfolio tools 10 Stocks the Best Fund. See the best investment apps by category as picked by the experts at Moneywise. From beginner investors to real estate and crypto investing, here's the best. Trading is great for beginners. Especially for Dividend Pies. You can invest as little as you want. They also offer helpful videos on. We invest in and partner with great technology companies to do even greater things. back-to-top. We are a leading private equity investment firm building on. This guide outlines the best investment apps available, regardless of what you'd like to trade or which strategy you wish to employ. Charles Schwab offers investment products and services, including brokerage and retirement accounts, online trading and more. Enter the world of the best AI investing apps, which transform the investing landscape by combining powerful artificial intelligence with user-friendly. REISift — CRM, Data Management, & Targeted Marketing. At REISift, we help real estate investors do more deals with the data they already have. Our software. In this guide, we're going to give you our top 9 picks — we'll even include a brief description, video demo, features list, and pricing for each software. The best apps for investing are Fidelity, SoFi Invest, TD Ameritrade, E-Trade, Robinhood, Merrill Edge, and Stash. This is my attempt of accumulating the best lessons from successful investors in SaaS Enterprise Investing. B2B SaaS is predominately an area I. SoFi Invest offers two types of investing: active stock trading and a passive, automated portfolio option. There are no annual management fees or monthly. The 4 Best Micro-Investing Apps of · Best Micro-Investing Apps of · Stash: Best Micro-Investing App for Hands-On Investors · SoFi Invest: Best Free Micro. Aladdin is a portfolio management software that provides investment professionals a way to view and manage daily investments Best buy-side IBOR (investment. Our fund management software makes it easier than ever to coordinate with investors, generate essential reports, and manage your investor communication needs. Here are the 13 best real estate investing software of that will help you find the best deals, analyze properties, and manage your portfolio with ease. Take the stress out of investing with automation. ; logo-investopedia-btmgrey Best Robo Advisor for Beginners ; BuySide. Best Overall Robo Advisor

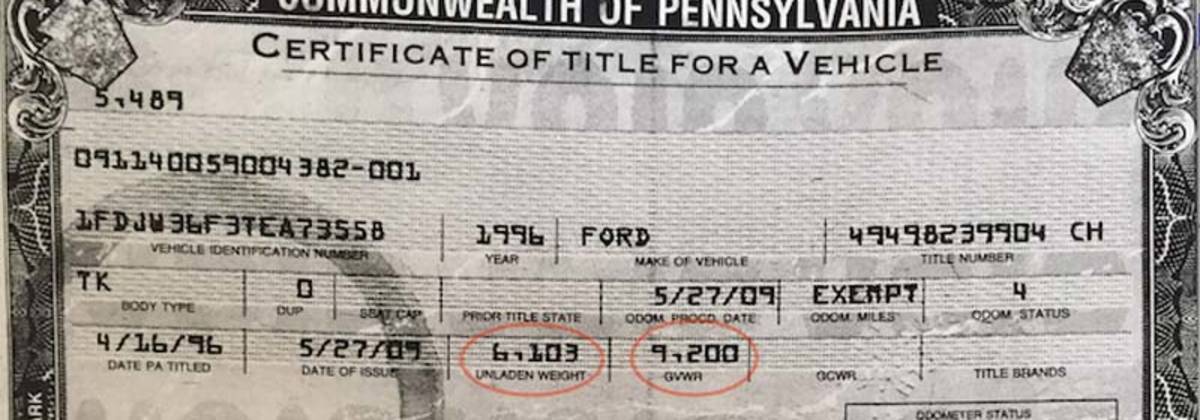

Value Of A Rebuilt Title

When they pass the test, they're redesignated as rebuilt title vehicles. Now that you know what a rebuilt title is, take a moment to learn about the value. Consequences of Owning and Operating a Georgia Salvaged Vehicle Salvaged vehicles, even if rebuilt, have a considerably lower resale value than their original. A rebuilt title typically devalues a car by 20% to 50% depending on the model, its age, the extent of its previous damages, and your location. Rebuilt Vehicles ; NMVTIS Brand, Description ; Rebuilt, Vehicle was previously branded “salvage” but was rebuilt to road worthiness. ; Prior Owner Retained. "Current salvage value," as applied to a vehicle, means (i) the salvage value of the vehicle, as determined by the insurer responsible for paying the claim, or. Rebuilt Title Car Value and Insurance. If you manage to find full coverage for your rebuilt title car, expect it to be valued around 50% of the retail cost of. Rebuilt Application and Inspection · Complete an application for rebuilt inspection (Apply for a Rebuilt Title) · Salvage certificate of title · All bills of sale. The average percentage for such vehicles lands at either 75% to 80% of the car's market value. Calculate the Salvage Value. Whatever percentage your insurance. As such, the selling price of the vehicle should be significantly lower than similar models that have a clean title—even if the rebuilt title car looks as good. When they pass the test, they're redesignated as rebuilt title vehicles. Now that you know what a rebuilt title is, take a moment to learn about the value. Consequences of Owning and Operating a Georgia Salvaged Vehicle Salvaged vehicles, even if rebuilt, have a considerably lower resale value than their original. A rebuilt title typically devalues a car by 20% to 50% depending on the model, its age, the extent of its previous damages, and your location. Rebuilt Vehicles ; NMVTIS Brand, Description ; Rebuilt, Vehicle was previously branded “salvage” but was rebuilt to road worthiness. ; Prior Owner Retained. "Current salvage value," as applied to a vehicle, means (i) the salvage value of the vehicle, as determined by the insurer responsible for paying the claim, or. Rebuilt Title Car Value and Insurance. If you manage to find full coverage for your rebuilt title car, expect it to be valued around 50% of the retail cost of. Rebuilt Application and Inspection · Complete an application for rebuilt inspection (Apply for a Rebuilt Title) · Salvage certificate of title · All bills of sale. The average percentage for such vehicles lands at either 75% to 80% of the car's market value. Calculate the Salvage Value. Whatever percentage your insurance. As such, the selling price of the vehicle should be significantly lower than similar models that have a clean title—even if the rebuilt title car looks as good.

Cars with rebuilt titles have a major accident and extensive repairs in their history. This usually drives the price down quite a bit compared to a similar. A vehicle is considered wrecked or salvaged when it has repair costs exceeding 70 percent of its fair market value before it became damaged and had a fair. Rebuilt title cars typically have lower resale values compared to clean title cars, but they can still offer good value depending on their condition and market. A salvage vehicle is a vehicle damaged to the extent that the cost of repairing the vehicle for safe operation exceeds its fair market value. If they did a bondo-repair and paint for few thousand the sellable value would increase to maybe $17, With a salvage title you will never, ever, stand a. In North America, a salvage title is a form of vehicle title branding, which notes that the vehicle has been damaged and/or deemed a total loss by an. A Rebuilt title vehicle is worth % of its clean title value. WILL MY BANK FINANCE A SALVAGE/ REBUILT VEHICLE? Most banks will Not finance salvage / rebuilt. Low Resale Value: When it comes time for you to sell your vehicle, it will have a low resale value. Additionally some dealerships don't buy rebuilt title. A common rule of thumb is that a vehicle with a salvaged title is worth approximately half of what it would be with a clean title, while insurance companies may. If the car is a salvage vehicle, the price should be much lower than the price of a similar car with a clean title. Consider that you may have difficulty later. Cars with rebuilt titles have typically been declared total losses by an insurance company and then repaired for resale. · A car with a rebuilt title should sell. Low Resale Value: When it comes time for you to sell your vehicle, it will have a low resale value. Additionally some dealerships don't buy rebuilt title. A rebuilt title is given to a refurbished vehicle that previously had a salvage title. There are a few different ways that vehicles can get a salvage title. There's the car's value after being declared a total loss. Status shows that rebuilt title cars are worth 20% to 40% less than their standard value. This. Rebuilt Application and Inspection · Complete an application for rebuilt inspection (Apply for a Rebuilt Title) · Salvage certificate of title · All bills of sale. A salvage vehicle is one where the estimated cost to repair it is greater than the overall value of the vehicle. Salvage can be a very broad term. If you have a. The salvage value of a damaged car is the value it holds after the collision, even though it is worth less than it was before. Auto salvage value is the value. There's no exact formula used to calculate salvage title values as it all depends on your car's year, amount of damage done, make, model, type and the state you. Salvage value refers to the value of the remaining parts in a vehicle. For instance, the engine, transmission and catalytic converter retain a lot of value. Cars with rebuilt titles may be cheaper, but they could have potential hidden issues and an even lower value if you resell them. Getting insurance for rebuilt.