medicinetizer.ru

Learn

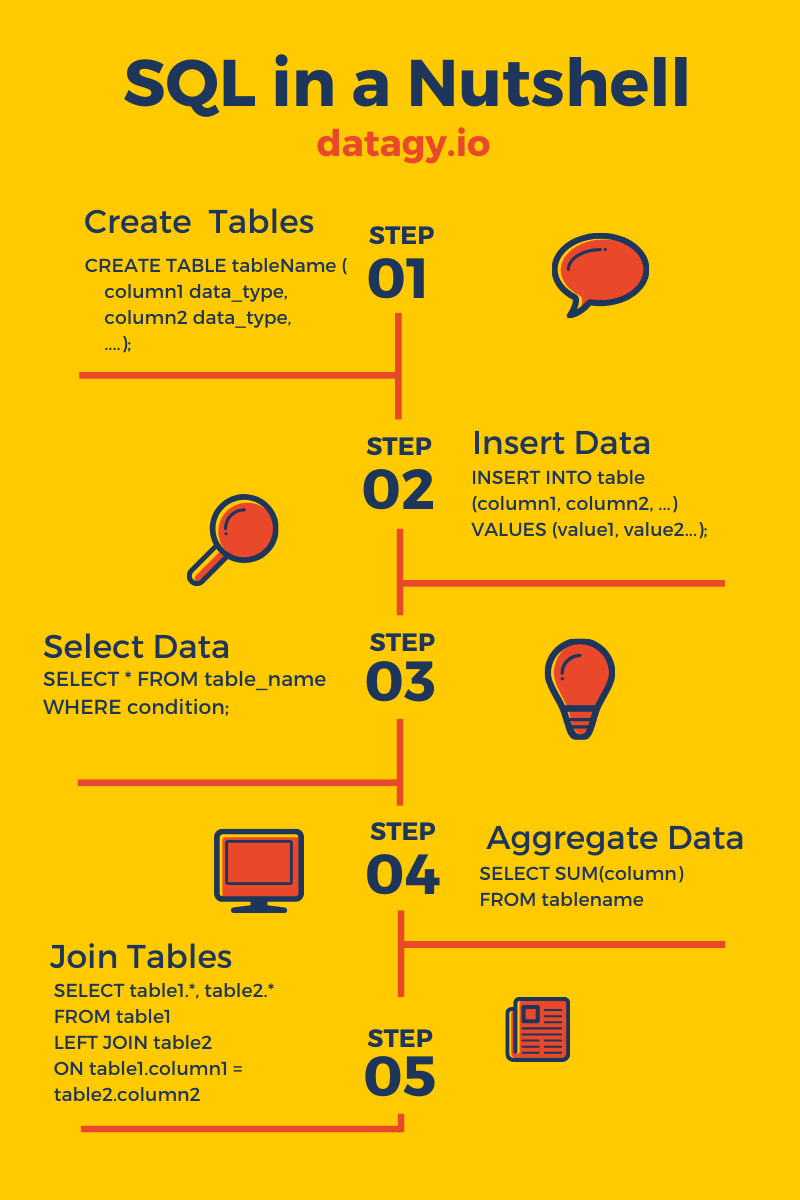

Is Sql Hard To Learn

I'd probably suggest SQL, as it's easier to learn and more independently useful. You will have a hard time getting used to the on-the-job. In my opinion sql is easy to learn the basics in. Mainly because you can see what the data looks like before and after by looking at the raw data itself. SQL is not very hard to learn. If you practice a little every day, you will get better over time. There are many resources that make learning. What is SQL? · It's semantically easy to understand and learn. · Because it can be used to access large amounts of data directly where it's stored, analysts don't. If you are thinking of upskilling or just curious about how difficult it would be to pick up SQL in your career goals, you are in for a. Being an SQL developer is not as easy as mastering SQL code and queries, as you'll be working on different databases and need to know the database architecture. SQL is not very hard to learn. If you practice a little every day, you will get better over time. There are many resources that make learning. Is SQL hard to learn? It can be. But with the right approach and a little stubborn determination, it might just become your favourite way to solve problems. If you are thinking of upskilling or just curious about how difficult it would be to pick up SQL in your career goals, you are in for a. I'd probably suggest SQL, as it's easier to learn and more independently useful. You will have a hard time getting used to the on-the-job. In my opinion sql is easy to learn the basics in. Mainly because you can see what the data looks like before and after by looking at the raw data itself. SQL is not very hard to learn. If you practice a little every day, you will get better over time. There are many resources that make learning. What is SQL? · It's semantically easy to understand and learn. · Because it can be used to access large amounts of data directly where it's stored, analysts don't. If you are thinking of upskilling or just curious about how difficult it would be to pick up SQL in your career goals, you are in for a. Being an SQL developer is not as easy as mastering SQL code and queries, as you'll be working on different databases and need to know the database architecture. SQL is not very hard to learn. If you practice a little every day, you will get better over time. There are many resources that make learning. Is SQL hard to learn? It can be. But with the right approach and a little stubborn determination, it might just become your favourite way to solve problems. If you are thinking of upskilling or just curious about how difficult it would be to pick up SQL in your career goals, you are in for a.

Fluency in database management and SQL is a must if you want to progress in your data science career. You can learn more about what SQL is used for in our full. You get the idea now. SQL is hard to master, and even more so if you miss the first steps. I got you here. You need to make sure you understand the. The basics of SQL are very simple to learn. Things like creating databases, tables, adding and manipulating data is all very simple. You just. In conclusion, SQL can be hard to learn for some people, but not necessarily for everyone. Factors such as prior programming experience. Learning SQL can be challenging due to advanced concepts such as recursive queries, query tuning, temporary functions, and self-joins. Enrolling in live online. The challenges of learning SQL Server depend on factors like your knowledge of programming languages, your experience working with data and data analytics. Learn JDBC The Hard Way: A Hands-On Guide to PostgreSQL and SQL Server Driven Programming: Computer Science Books @ medicinetizer.ru Fluency in database management and SQL is a must if you want to progress in your data science career. You can learn more about what SQL is used for in our full. It has been many months now since I first got to know what even the full form of SQL was. hard truths when you're in the wrong direction. Search code, repositories, users, issues, pull requests · Provide feedback · Saved searches · medicinetizer.ru · medicinetizer.ru SQL is not difficult to learn. It's actually quite easy once you know the syntax of the language. Most people start with an online SQL tutorial. SQL is not a difficult language to learn, and the basics can be picked up in 2 weeks if you're diligent. You get the idea now. SQL is hard to master, and even more so if you miss the first steps. I got you here. You need to make sure you understand the. Learning SQL can be daunting, despite the incredible availability of reference materials. Sometimes the best way to learn is to get your hands dirty. SQLisHard. Module Learn SQL the Hard Way. An introductory course in the SQL programming data language. Preface. This is a simple course that teaches you the basics of SQL. Learn SQL The Hard Way is a crash course in the basics of SQL to store, structure, and analyze data. With this book you can understand what is going on in your. SPL, as a technology specifically used for processing structured data and semi-structured data, is often faster than SQL by several to hundreds of times in. Packed with examples, this free book is a step-by-step introduction to learning SQL. You'll discover how easy it is to use SQL to interact with. Its not very hard and you can learn it very quickly. Follow this interactive online SQL training for beginners (and for FREE) and in no time you will learn all. They are approaching the world from different points of view. C is about performing actions. SQL is about storing data, and manipulating.

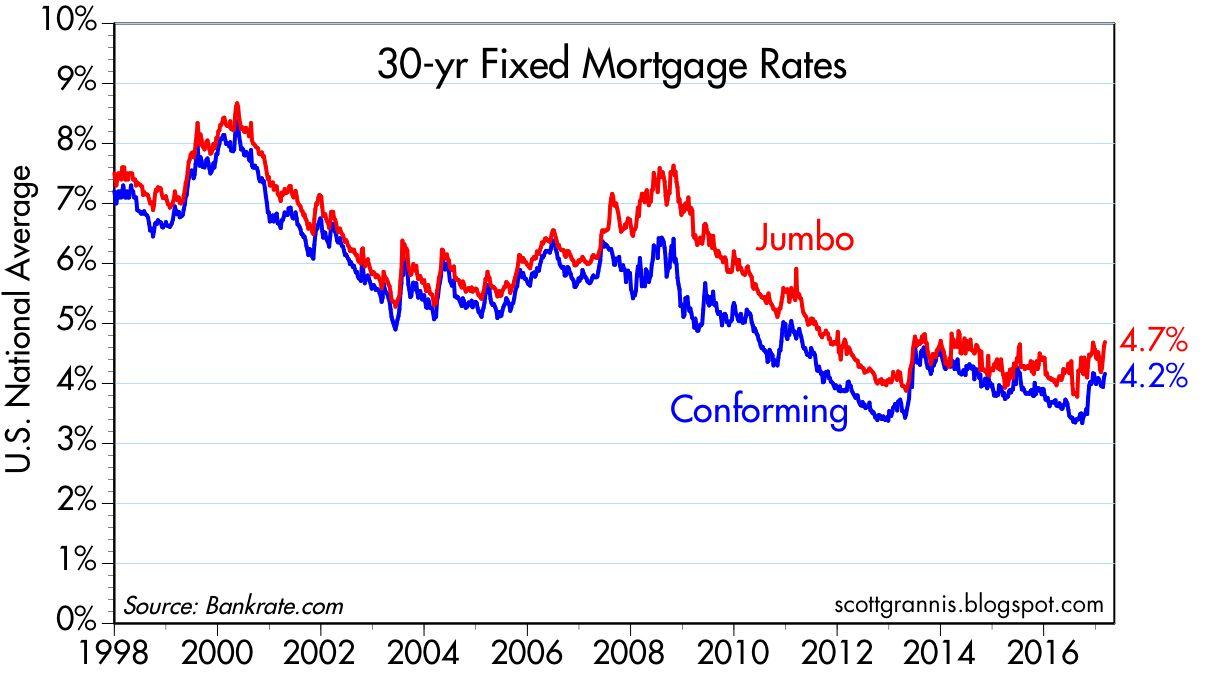

Fixed Mortgage Interest Rates Today

Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. % ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. % ; Jumbo. Customized mortgage rates ; year fixed, % (%), $84 credit to closing costs, $2, ; year fixed, % (%), $4 added to closing costs. View current interest rates for a variety of mortgage products, and learn how we can help you reach your home financing goals. NerdWallet's mortgage rate insight On Tuesday, September 17, , the average APR on a year fixed-rate mortgage rose 8 basis points to %. The average. Home equity loans ; Home equity line of credit · %, % Variable ; year fixed home equity loan · % · %. Chase offers mortgage rates, updated daily Mon-Fri, with various loan types. Review current mortgage rates, tools, and articles to help choose the best. 29 minutes ago. Compare our current interest rates ; year fixed, %, %, ($), $ ; FHA loan, %, %, ($), $ Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. % ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. % ; Jumbo. Customized mortgage rates ; year fixed, % (%), $84 credit to closing costs, $2, ; year fixed, % (%), $4 added to closing costs. View current interest rates for a variety of mortgage products, and learn how we can help you reach your home financing goals. NerdWallet's mortgage rate insight On Tuesday, September 17, , the average APR on a year fixed-rate mortgage rose 8 basis points to %. The average. Home equity loans ; Home equity line of credit · %, % Variable ; year fixed home equity loan · % · %. Chase offers mortgage rates, updated daily Mon-Fri, with various loan types. Review current mortgage rates, tools, and articles to help choose the best. 29 minutes ago. Compare our current interest rates ; year fixed, %, %, ($), $ ; FHA loan, %, %, ($), $ Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet.

View daily mortgage and refinance interest rates for a variety of mortgage and home loans from Truist. Including rates for fixed, adjustable, FHA & VA. Today's Rate on a Year Fixed Mortgage Is % and APR % In a year fixed mortgage, your interest rate stays the same over the year period. Calculate your mortgage rate ; FHA Year · %. % ; Year Fixed · %. % ; Year Fixed · %. % ; VA Year Fixed · %. % ; 7/6. Know what the current mortgage interest rates are today, or get your own custom home mortgage rate. Compare 30 and 15 years fixed mortgage rates and more. For today, Tuesday, September 17, , the current average year fixed mortgage interest rate is %, falling 5 basis points over the last week. For. Mortgage rates today · yr fixed. Rate. %. APR. %. Points (cost). ($3,). Term. yr fixed. Rate · yr fixed FHA. Rate. %. APR. %. Today's loan purchase rates ; InterestSee note1 %, APRSee note2 %, Points ; InterestSee note1 %, APRSee note2 %, Points Personalize your rate ; 15 Year Fixed. $2, · % ; 20 Year Fixed. $2, · % ; 30 Year Fixed. $2, · %. You get a% interest rate relationship discount when you Bank with Key or when you sign up for automatic payments from a KeyBank checking account. Today's competitive mortgage rates ; year fixed · % · % · ; year fixed · % · % · ; 5y/6m ARM · % · % · Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. Mortgage rates have fallen more than half a percent over the last six weeks and are at their lowest level since February Rates continue to soften due to. The best way to get your current mortgage rate is to let us estimate it based on your unique details. We have two that show you what mortgage interest rates. The year fixed mortgage rate on September 14, is down 19 basis points from the previous week's average rate of %. Additionally, the current national. Year Fixed Rate ; Rate: % ; APR: % ; Points ; Estimated Monthly Payment: $1, The current average year fixed mortgage rate fell 4 basis points from % to % on Saturday, Zillow announced. The year fixed mortgage rate on. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. Today's Mortgage Rates · year Fixed-Rate Loan: An interest rate of % (% APR) is for the cost of point(s) ($5,) paid at closing. · year. Explore today's mortgage rates and compare home loan options. When you're ready to apply, call Navy Federal at and get pre-approved for a. Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily, Freddie Mac, etc.

What Is The Best Investment For 5000 Dollars

And if you're investing fifty thousand dollars or more, you may also choose Get started with as little as $5, Backed by our commitment to. Dollar-cost averaging only makes sense if it aligns with your investing objectives. If you are investing in a stock or other asset because you like its long-. Investments: You might consider investing in stocks, bonds, or other investment vehicles depending on your risk tolerance and investment goals. Mutual funds continue to be among the most popular investing tools for both individual and professional investors who seek to beat the market or simply access a. investing with as little as a few thousand dollars. We've listed a number of investment options below for those who have S$5, to spare and the range goes. A $1 million investment in a money market account could earn you $5, per year in interest income. Another great option you can explore is the Lyons. Invest in High-Quality Dividend Stocks. This is one of the most popular answers to the question of what to invest dollars in. This amount. roll over $25,$99, Twenty-five thousand dollars to ninety-nine thousand nine hundred and ninety nine dollars Investing account (General Investment. Kenneth Chavis IV, CFP and senior wealth manager at LourdMurray, suggests money market funds “for those who are not comfortable with investment risk but want to. And if you're investing fifty thousand dollars or more, you may also choose Get started with as little as $5, Backed by our commitment to. Dollar-cost averaging only makes sense if it aligns with your investing objectives. If you are investing in a stock or other asset because you like its long-. Investments: You might consider investing in stocks, bonds, or other investment vehicles depending on your risk tolerance and investment goals. Mutual funds continue to be among the most popular investing tools for both individual and professional investors who seek to beat the market or simply access a. investing with as little as a few thousand dollars. We've listed a number of investment options below for those who have S$5, to spare and the range goes. A $1 million investment in a money market account could earn you $5, per year in interest income. Another great option you can explore is the Lyons. Invest in High-Quality Dividend Stocks. This is one of the most popular answers to the question of what to invest dollars in. This amount. roll over $25,$99, Twenty-five thousand dollars to ninety-nine thousand nine hundred and ninety nine dollars Investing account (General Investment. Kenneth Chavis IV, CFP and senior wealth manager at LourdMurray, suggests money market funds “for those who are not comfortable with investment risk but want to.

Heres what I'd do 90% goes into an S&P ETF (ie. VFV), and 10% towards growth stocks (ie. tech). Remeber, we all have different investing goals. Although there are mutual funds with no minimums, most mutual funds require a minimum investment of generally $ to $5,, depending on the manager and. To see the power of long-term saving and investing, check out Edward Jones' investment calculator; just enter the initial investment amount, an estimated rate. Where to Invest $10, Right Now · Emphasize Income. Before the market's recent rally sputtered out, many were asking if it was time to start adding back equity. Investing in individual stocks that pay dividends is a smart strategy. You will have the option of receiving the dividends as cash payouts or reinvesting them. Customers must open and fund a new J.P. Morgan Self-Directed Investing account with new money of $5, or more by moving cash, transferring securities, or. Enter a dollar value of an investment at the outset. Input a starting year Enter the amount of money you are investing. Start year. Enter the year. Regular investments in low fee index funds can be a great way to invest, either through a retirement fund, k, SEP-IRA, etc. Total market index funds that. From there; if you do not already have an individual ROTH IRA, that is a great place to start. Any money you contribute (up to $6, in ). While the Northern Bank Direct Money Market Account requires a much higher minimum opening deposit of $, the % APY could make that investment worth it. Who are they good for? A high-yield savings account works well for risk-averse investors, and especially for those who need money in the short term and want to. On the other hand, if you are saving for a short-term goal, five years or less, you don't want to choose risky investments, & Poor's , the Wilshire Turn HSA dollars sitting in cash into opportunity. Investing a portion of your HSA balance in mutual funds could add up over time. To illustrate the impact of. investing. Most brokerage firms that offer mutual funds and index funds require a starting balance of a few hundred dollars to $1, or more. You can buy. Get the shortcuts to all the support documentation on using Cash App for investing. Buy and sell stocks in-app. The power of long term investing. See how a recurring transfer can help grow your investment over time through compounding and dollar-cost averaging. This. Retirement accounts like employer-sponsored (k)s or individual retirement accounts (IRAs) are tax-advantaged investment accounts that can be great for the. Index) through Vanguard ETF® Shares are not redeemable with the issuing fund other than in very large aggregations worth millions of dollars. “Best” for me was the stock market. Stocks can be a lucrative investment if you do your homework or have good advice. I was in this same. If you have checked the box to show values after inflation, this amount is the total value of your investment in today's dollars. Best Safe Investments.

Best Lottostar Game To Play

Play Crystopia now on medicinetizer.ru with multipliers, wilds and scatters. All symbols can be split into 2 or 4 symbols with additional ways to win. Start with the demo version if you're new to Hot Hot Fruit Lottostar. This lets you get a feel for the game without risking real money. It's a great way to. Get transported into the Oriental world with our exciting Chinese-themed game, 5 Lucky Lions. You could win an instant payout of up to R20 Million in our Reel. Players can bet on the outcome of Italy's SuperEnaLotto, EuroMillions, Africa Millions, Kino 10, Kino 12, Kino 14, and Kino 16 games. A few of the additional. Get transported into the Oriental world with our exciting Chinese-themed game, 5 Lucky Lions. You could win an instant payout of up to R20 Million in our Reel. best deposit bonuses, free spins offers and no deposit bonuses Hot Hot Fruit by Habanero Games is classed as a high-volatility online slot game. LottoStar offers Live Games from Evolution & Ezugi providers. Play Live Blackjack, Poker, Roulette, Game Shows, Bollywood First Person Games, Baccarat & Sic. Play Free Bet Blackjack on medicinetizer.ru Achieve a higher card count than the dealer but without going over 21 & WIN instant payouts with our Live Games. Play Wild Pups now on medicinetizer.ru SPIN the NEON WHEEL to collect amazing wins. WILD symbol replaces any symbol except the scatter. Quick Games. Play Crystopia now on medicinetizer.ru with multipliers, wilds and scatters. All symbols can be split into 2 or 4 symbols with additional ways to win. Start with the demo version if you're new to Hot Hot Fruit Lottostar. This lets you get a feel for the game without risking real money. It's a great way to. Get transported into the Oriental world with our exciting Chinese-themed game, 5 Lucky Lions. You could win an instant payout of up to R20 Million in our Reel. Players can bet on the outcome of Italy's SuperEnaLotto, EuroMillions, Africa Millions, Kino 10, Kino 12, Kino 14, and Kino 16 games. A few of the additional. Get transported into the Oriental world with our exciting Chinese-themed game, 5 Lucky Lions. You could win an instant payout of up to R20 Million in our Reel. best deposit bonuses, free spins offers and no deposit bonuses Hot Hot Fruit by Habanero Games is classed as a high-volatility online slot game. LottoStar offers Live Games from Evolution & Ezugi providers. Play Live Blackjack, Poker, Roulette, Game Shows, Bollywood First Person Games, Baccarat & Sic. Play Free Bet Blackjack on medicinetizer.ru Achieve a higher card count than the dealer but without going over 21 & WIN instant payouts with our Live Games. Play Wild Pups now on medicinetizer.ru SPIN the NEON WHEEL to collect amazing wins. WILD symbol replaces any symbol except the scatter. Quick Games.

Even the worst slots, only hold 20% of the money deposited. Meaning they have a 20% house edge. Lottery games hold about 50% usually. Never play. Enjoy LottoStar's Arcade Games like Maverick, Aviator, Maverick X, Mines, Crash X, Plinko Go & many more. Play now to relive the joy of your nostalgic. Set off on an adventure into the empirical city of ancient China in our exciting Ways of Fortune Reel Rush Game. Win maximum payouts of up to R20 Million. LottoStar: Looking for Quick Games to play online? Try our ScratchCards and some of our Top Games like Aviator, Moonshine, Mega Top Shot, Chest Hunter and. Play Top Shot now on medicinetizer.ru WILD symbol replaces all other symbols except the Top Shot scatter symbol. All wins pay from left to right. Play Top Shot now on medicinetizer.ru WILD symbol replaces all other symbols except the Top Shot scatter symbol. All wins pay from left to right. Air Dice is now a top Dice Game supplier for the Belgian online casino market and a household name in the global dice game vertical. Play Book of Riches on medicinetizer.ru Spin the reels on our Reel Rush Games for payouts of up to R20 Million. No time to relax Guys I've found new secret of Spinazonke Game settings I know I always charge but Stop wasting your money playing. Random Reels: LottoStar introduces our new Quick Game with triple 7, watermelon, grapes, strawberries and many other symbols. Get the correct combinations. Immortal Ways Lottostar slot online for free in demo mode. Play free casino games, no download and no registration required. Golden Unicorn is a fairy tale-inspired game with wild bonuses, free spins, scatter symbols and many other amazing features. Play The Big Deal now on medicinetizer.ru The male player with cards-in-hand symbol substitutes all other symbols except the scatter. SPIN & WIN great. Jackpot Slots Game All new users can get 20Free Play Instant Cashout and Best Service True redemption Up to % deposit bonus promotion. Top GamesSlotteriesLotteries · Arcade Games By playing this game you agree to the Terms and Conditions. The visual and. Reel Rush. Reel Rush. Reel Rush. Top Games. Habanero. Ruby. Red Rake. Privé. 1x2 Gaming. Jackpot Race. Top Games, Habanero, Ruby, Red Rake, Privé. There are also niche casino games, like scratch cards and keno. Besides being an exceptional online casino, Lottostar is also a low deposit casino. Lottostar is. From everyone's favourite Saturday Lotto, to the dizzying wins of Powerball and the little surprises from Cash 3, our great range of games is guaranteed to. Best LottoStar Games To Play ; Aviator Game. Spribe ; Image for Monopoly Big Baller Live. Monopoly Big Baller · Evolution Gaming ; Logo image for Mystic Fortune. Who are you trying to fool with your worthless scratch card games. I've been playing them for a few months and not even a r has come my medicinetizer.ru platform.

Mortgage Comparators

This calculator helps you consider all associated costs and determine which loan is best for you. Use our loan comparison calculator to see how. Business Loan Comparator: Compare your Business Loan interest rates on Moneycontrol. Check lowest home loan rates and apply online for best Business Loan. Find and compare mortgage deals in under two minutes. We'll tailor the results for you, whether it's remortgaging or buying your first home. ANZ · Business Loans · Credit and Charge Cards · Overdrafts · Personal Loans · Regulated Trust Accounts · Residential Mortgages · Term Deposits · Transaction and. Compare mortgage interest rates to find the best mortgage rates for your home loan. See daily average mortgage rate trends and the rates forecast for NerdWallet's credit card comparison tool allows you to compare cards side-by-side. Click to discover which is the right one for you. Compare the best mortgage rates across the whole market – thousands of mortgages from over 90 lenders! Find your perfect mortgage now. Compare our best loan rates. Find a loan, go to your account, check eligibility before you apply, without impacting your credit score. Search for a loan from. Mortgage comparison helps you find out how much you can borrow and what the repayments will cost. MoneySuperMarket explores it all, including remortgages. This calculator helps you consider all associated costs and determine which loan is best for you. Use our loan comparison calculator to see how. Business Loan Comparator: Compare your Business Loan interest rates on Moneycontrol. Check lowest home loan rates and apply online for best Business Loan. Find and compare mortgage deals in under two minutes. We'll tailor the results for you, whether it's remortgaging or buying your first home. ANZ · Business Loans · Credit and Charge Cards · Overdrafts · Personal Loans · Regulated Trust Accounts · Residential Mortgages · Term Deposits · Transaction and. Compare mortgage interest rates to find the best mortgage rates for your home loan. See daily average mortgage rate trends and the rates forecast for NerdWallet's credit card comparison tool allows you to compare cards side-by-side. Click to discover which is the right one for you. Compare the best mortgage rates across the whole market – thousands of mortgages from over 90 lenders! Find your perfect mortgage now. Compare our best loan rates. Find a loan, go to your account, check eligibility before you apply, without impacting your credit score. Search for a loan from. Mortgage comparison helps you find out how much you can borrow and what the repayments will cost. MoneySuperMarket explores it all, including remortgages.

Are you on the best mortgage or home loan rate? Compare mortgage rates online with daily rates from NZ banks and lenders. Find the latest interest rates in NZ. Compare home loan and mortgage rates from major banks. Get expert advice and save on your mortgage with Squirrel. Ontario Mortgage Brokerage #, Quebec medicinetizer.ru Mortgage Brokerage Firm # - Ratehub Inc. o/a medicinetizer.ru & CanWise Financial is a licensed. mortgage ratesVA mortgage ratesBest mortgage lenders. Best mortgage lenders Personal loans guideGetting a personal loanPayday Loan AlternativesManaging a. RATESDOTCA instantly finds your best rates for insurance, mortgage & credit cards by comparing quotes from major Canadian brokers & financial institutions. To do this, you request, review, and compare Loan Estimates from multiple lenders to determine what loan and lender is right for you. Malcolm Davidson. Mortgage Thought Leader | Independent Mortgage Broker | Age 50+ Mortgage Specialists | Regulated Bridging Loans | B2B Referral. Compare all mortgage rates. Interest rates updated on Overview year fixed-rate with NHG. of a state bank on lending in other states, one relatively straightforward (and rough) way to estimate this effect is to compare the change in loan to asset. However, the percent of bank loans exceeds the aggregate comparators of small business loans in the AA. mortgage lenders that conduct business or have. Whether you are a first-time buyer, or you're looking to switch or move home, use our mortgage comparisons to find the best mortgage for you. RATESDOTCA instantly finds your best rates for insurance, mortgage & credit cards by comparing quotes from major Canadian brokers & financial institutions. Home Loan Comparator: Compare your Home Loan interest rates on Moneycontrol. Check lowest home loan rates and apply online for best Home Loan. Compare hundreds of home loans from a range of lenders with fixed rates starting at % (comparison rate %) – start your search for a great home loan. A cost of living index allows you to directly compare what it costs to live in one area against another, helping you understand how far your money can go in. Compare loans from multiple providers without affecting your credit score. Find the right loan for you in just a few clicks with medicinetizer.rue. Evaluate Canada's best mortgage rates in one place. RATESDOTCA's Rate Matrix lets you compare pricing for all key mortgage types and terms. middle-income comparator countries; Turkey has a less developed home mortgage market, and. Mexico has a more developed one. Section IV provides a simulation. Compare Ireland's mortgage interest rates. Discover the best, low rate mortgages for switchers and first time buyers from Ireland's top lenders. Explore all mortgages resources. Mortgages. Compare rates. Mortgage rates · year mortgage rates · year mortgage rates · VA loan rates. Get guidance.

Can I Contribute To A Roth And A 401k

Roth (k) contribution limits. The maximum amount you can contribute to a Roth (k) for is $23, if you're younger than age This is an extra. For (k) accounts, the contribution limit is $, or $ for employees over For traditional and Roth IRA plans, the limit is $ The easy answer to your second question is again, yes, you can potentially contribute to a Roth IRA even if you contribute the yearly maximum. A (k) contribution can be an effective retirement tool. The Roth (k) allows you to contribute to your (k) account on an after-tax basis - and pay. Both Plans now give you the flexibility to designate all or a portion of your contributions as Roth contributions. Roth (after-tax) and traditional (before-tax). Participants who make Roth (k) contributions within the (k) plan may also make Roth IRA contributions to their Roth IRA up to the stated Roth IRA. You can contribute to both a (k) and an IRA, as long as you keep your contributions to certain limits. For , you can contribute up to $23, to a (k). There are no income limits on Roth conversions and no limits on how much you can convert, as long as you pay the applicable federal and potentially state income. The (k) contribution limit for is $22, for employee contributions and $66, for combined employee and employer contributions. If you're age 50 or. Roth (k) contribution limits. The maximum amount you can contribute to a Roth (k) for is $23, if you're younger than age This is an extra. For (k) accounts, the contribution limit is $, or $ for employees over For traditional and Roth IRA plans, the limit is $ The easy answer to your second question is again, yes, you can potentially contribute to a Roth IRA even if you contribute the yearly maximum. A (k) contribution can be an effective retirement tool. The Roth (k) allows you to contribute to your (k) account on an after-tax basis - and pay. Both Plans now give you the flexibility to designate all or a portion of your contributions as Roth contributions. Roth (after-tax) and traditional (before-tax). Participants who make Roth (k) contributions within the (k) plan may also make Roth IRA contributions to their Roth IRA up to the stated Roth IRA. You can contribute to both a (k) and an IRA, as long as you keep your contributions to certain limits. For , you can contribute up to $23, to a (k). There are no income limits on Roth conversions and no limits on how much you can convert, as long as you pay the applicable federal and potentially state income. The (k) contribution limit for is $22, for employee contributions and $66, for combined employee and employer contributions. If you're age 50 or.

You pay the taxes on contributions and earnings when the savings are withdrawn. As a benefit to employees, some employers will match a portion of an employee's. Effective for contributions and later, anyone with earned income can open and contribute to a traditional or Roth IRA. For contributions and earlier. Now, thanks to SECURE Act , employer profit-sharing contributions can be made as Roth. This brings the total Roth contribution limit for to $69, or. If you have after-tax money in your traditional (k), (b), or other workplace retirement savings account, you can roll over the original contribution. The simple answer is yes, you can. However, there are some caveats when it comes to deducting your IRA contributions if you participate in both types of plans. Can a person who is employed by an employer and also has an unrelated self-employed business set up an individual (k) plan, and also contribute to the. The maximum amount you may contribute to the State of Michigan (k) Plan, including both pre-tax contributions and Roth contributions, is $18, for If. Yes, under certain circumstances you can have both a k and a Roth IRA. Understand the rules for contributing to a (k) and a Roth IRA, including limits. Luckily, you don't have to choose between making pre-tax and Roth contributions. Instead, you can contribute a mix of both based on your unique goals and. However, there is no income tax deduction for contributions to a Roth IRA or Roth (k) as there are for traditional IRAs or (k). Funds can be placed in. You can make both Traditional and Roth contributions to a (k), but they share a contribution limit. You can make both Traditional and Roth. Yes, you can do both a k and a traditional/roth IRA. They're considered separate retirement options and have separate contribution limits. Also, PSR (k) and plans have the advantage of higher contribution limits than a Roth IRA. How do Roth contributions affect my take-home pay? After-tax. With a Roth, you'll pay income tax on your contributions and enjoy tax-free distributions in retirement. That can make it a good option over a traditional plan. The Roth option allows you to pay taxes on contributions now so that you can take the money out tax-free in retirement. This gives you even more flexibility to. The contribution limits for a traditional (k) apply to a Roth (k). For , the maximum an individual can contribute to their (k) accounts is $20, Both Plans now give you the flexibility to designate all or a portion of your contributions as Roth contributions. Roth (after-tax) and traditional (before-tax). Individuals earning over $, ($,, if married) are not eligible to make Roth IRA contributions. However, Roth (k)s are not subject to these income. Your combined contributions to a Roth (k) and a traditional pretax (k) cannot exceed IRS limits. • Your contribution is based on your eligible. Roth (k) contributions are irrevocable; once money is invested into a Roth (k) account, it cannot be moved to a regular (k) account. · Employees can.

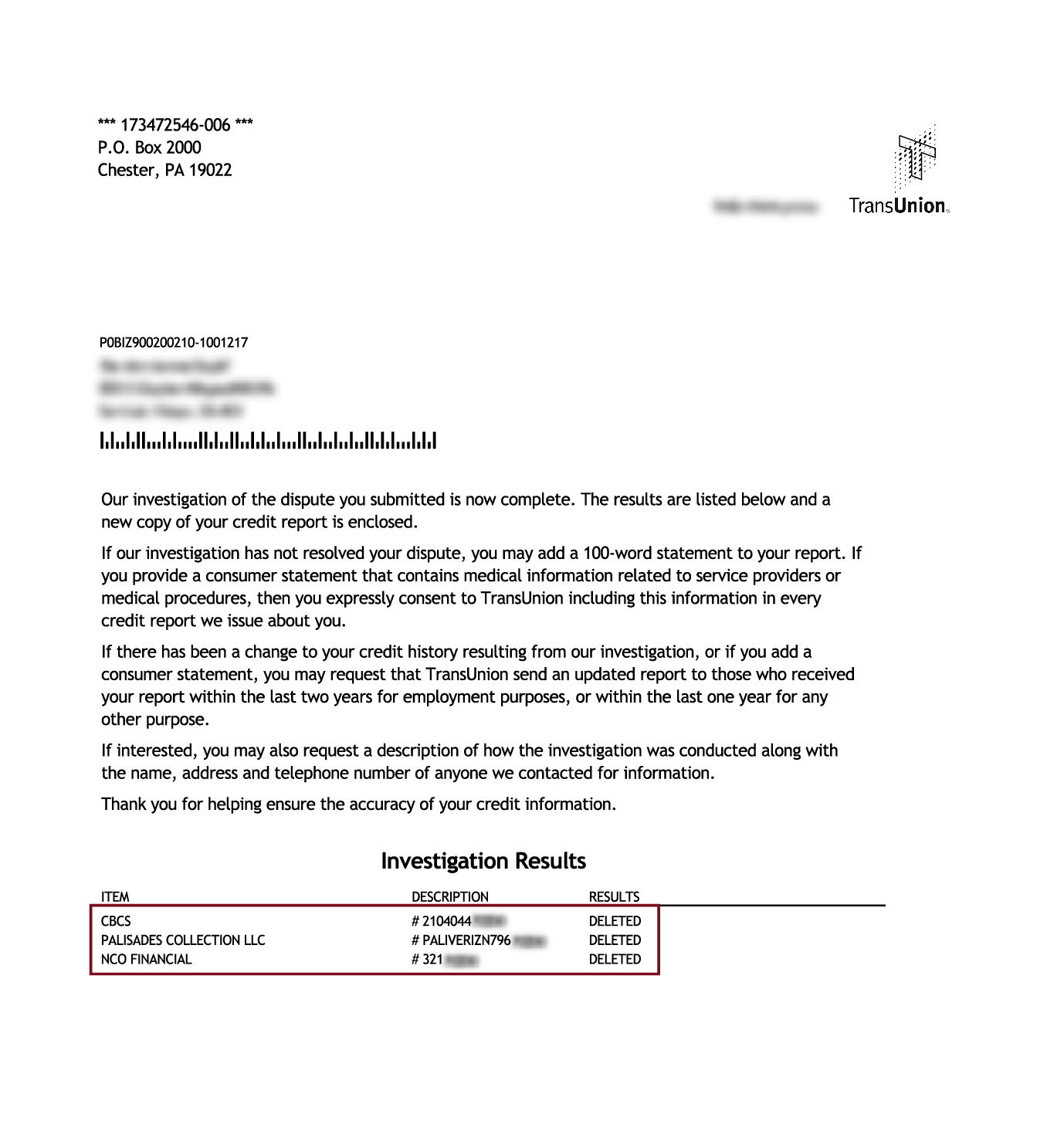

Removing Collections From Credit Report

You can negotiate with debt collection agencies to remove negative information from your credit report. If you're negotiating with a collection agency on. If the debt is valid but you've since paid it off, negotiate with the creditor or collection agency for a “pay-for-delete” agreement. This is where you agree to. No, you cannot have the collection account removed from your report. (Unless you can somehow claim the account is fraudulent or invalidated. Is there information on your credit report that's correct — just not so good? No one promising to repair your credit can legally remove information if it's. How to get collections off your credit report · 1. Send a dispute · 2. Negotiate a pay-for-delete agreement · 3. Ask for a goodwill deletion. Contrary to what many consumers think, paying off an account that's gone to collections will not improve your credit score. The information provided on this. "As to the debt collector, you can ask them to pay for delete," says McClelland. "This is completely legal under the FCRA. If going this route, you will need to. If enough time passes following a late payment, the creditor may transfer your account to a collection agency or sell your debt to a third party. In this. A Credit Reporting Attorney Can Help. Remember, accuracy in your credit report is crucial for your financial well- being. Taking prompt action to dispute. You can negotiate with debt collection agencies to remove negative information from your credit report. If you're negotiating with a collection agency on. If the debt is valid but you've since paid it off, negotiate with the creditor or collection agency for a “pay-for-delete” agreement. This is where you agree to. No, you cannot have the collection account removed from your report. (Unless you can somehow claim the account is fraudulent or invalidated. Is there information on your credit report that's correct — just not so good? No one promising to repair your credit can legally remove information if it's. How to get collections off your credit report · 1. Send a dispute · 2. Negotiate a pay-for-delete agreement · 3. Ask for a goodwill deletion. Contrary to what many consumers think, paying off an account that's gone to collections will not improve your credit score. The information provided on this. "As to the debt collector, you can ask them to pay for delete," says McClelland. "This is completely legal under the FCRA. If going this route, you will need to. If enough time passes following a late payment, the creditor may transfer your account to a collection agency or sell your debt to a third party. In this. A Credit Reporting Attorney Can Help. Remember, accuracy in your credit report is crucial for your financial well- being. Taking prompt action to dispute.

The goal of a pay for delete arrangement is to get a collection agency to remove a collection account entirely from your credit report before the Fair Credit. In exchange for full or partial payment, the collector agrees to remove a collection account from your credit report. In theory, that eliminates the credit. Pay for Delete: Some creditors might be willing to remove the charge-off from your credit report if you pay the outstanding debt. This is known as a “pay for. When an item is paid off through a collection agency or similar methods, it doesn't immediately disappear from your credit report. Options for Removing Collections From Your Credit Report · Request a goodwill deletion. Ask the collection agency to remove the collection account upon paying. You will have to call the collections agency directly, not your apartment, and ask for a "pay for delete". Ask that since the debt will be. The letter can be written to request that the collection agency remove paid collections and explain your circumstances. Explain how your credit score increase. To correct mistakes in your report, contact the credit bureau and the business that reported the inaccurate information. Tell them you want to dispute that. Typically, when you pay a derogatory account, it updates as a paid derogatory and remains on your credit report. This is better than unpaid, but. You can try to negotiate with the collection agency to have the collection removed. You would pay a fee to the collection agency and they would stop reporting. Steps to Remove Collections from Your Credit Report · Verify the Collection: Before taking any action, ensure the collection is accurate. · Dispute Inaccuracies. Even if you paid off a collections account, it will appear on your report for up to 7 years. An exception is medical debt, which is removed from your credit. In exchange, the collector agrees to remove the collection account from your credit report. In some cases, a collector may require a debt to be paid in full to. The account will be marked on your credit report with a "collection" status. 2. What is a third-party collection? Third-party collections are collection efforts. Contrary to what many consumers think, paying off an account that's gone to collections will not improve your credit score. The information provided on this. How to Remove Old Debt From Your Credit Report · 1. Pull your free credit reports · 2. Find out when the debt will fall off · 3. File a dispute · 4. Get outside. Prepare a dispute letter to mail to Experian, Equifax & TransUnion requesting the fraudulent account(s) be removed from your credit reports. A sample letter can. If you have a debt settlement noted on your credit report, you might wonder if you can remove that entry. Unfortunately, the answer is no in most cases. Creditors often don't verify the information within the day window. The negative data is indeed removed, resulting in a credit score bump -- at least. The account will be marked on your credit report with a "collection" status. 2. What is a third-party collection? Third-party collections are collection efforts.

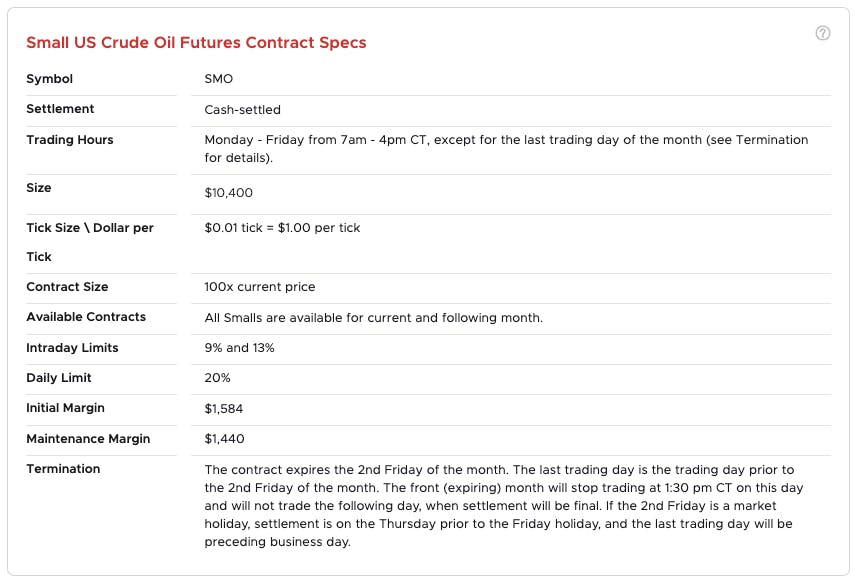

Current Crude Oil Futures Contract

Crude Oil WTI Futures - Oct 24 (CLV4) ; Prev. Close: ; Open: ; Day's Range: ; 52 wk Range: ; 1-Year Change: %. To wit, buyers and sellers establish a price that oil (or soybeans, or gold) will trade at not today, but on some coming date. While no one knows what price oil. Crude Oil WTI Oct '24 (CLV24) ; Daily Limit, 15% above or below previous settlement ; Contract Size, 1, U.S. barrels (42, gallons) ; Months, All Months. INE crude oil futures contract (SC) is a physical-settlement contract priced and traded in RMB. Listed on March 26, , SC is the first commodity futures. NYMEX Light Sweet Crude Oil (CL) futures are settled by CME Group staff based on trading activity on CME Globex during the settlement period. NYMEX Crude Oil Front Month · Price (USD) · Today's Change / % · Shares tradedk · 1 Year change% · 52 week range - crude oil today is $ per barrel. Live charts, historical data, futures contracts, and breaking news on WTI prices can be found below. Oct WTI crude oil (CLV24) Tuesday closed down (%), and Oct RBOB gasoline (RBV24) closed down (%). Crude oil and gasoline prices plunged. Crude Oil is expected to trade at USD/BBL by the end of this quarter, according to Trading Economics global macro models and analysts expectations. Crude Oil WTI Futures - Oct 24 (CLV4) ; Prev. Close: ; Open: ; Day's Range: ; 52 wk Range: ; 1-Year Change: %. To wit, buyers and sellers establish a price that oil (or soybeans, or gold) will trade at not today, but on some coming date. While no one knows what price oil. Crude Oil WTI Oct '24 (CLV24) ; Daily Limit, 15% above or below previous settlement ; Contract Size, 1, U.S. barrels (42, gallons) ; Months, All Months. INE crude oil futures contract (SC) is a physical-settlement contract priced and traded in RMB. Listed on March 26, , SC is the first commodity futures. NYMEX Light Sweet Crude Oil (CL) futures are settled by CME Group staff based on trading activity on CME Globex during the settlement period. NYMEX Crude Oil Front Month · Price (USD) · Today's Change / % · Shares tradedk · 1 Year change% · 52 week range - crude oil today is $ per barrel. Live charts, historical data, futures contracts, and breaking news on WTI prices can be found below. Oct WTI crude oil (CLV24) Tuesday closed down (%), and Oct RBOB gasoline (RBV24) closed down (%). Crude oil and gasoline prices plunged. Crude Oil is expected to trade at USD/BBL by the end of this quarter, according to Trading Economics global macro models and analysts expectations.

Get WTI Crude (Oct'24) (@CLNew York Mercantile Exchange) real-time stock quotes, news, price and financial information from CNBC. Futures Overview ; Crude Oil Continuous Contract, $, ; Brent Crude Oil Continuous Contract, $, ; Natural Gas Continuous Contract, $ 1/2 the size ( barrels) of the NYMEX WTI Light Sweet Crude Oil futures contract (CL). It is the most efficient way to trade today's global oil markets. Underlying, DGCX West Texas Intermediate Light Sweet Crude Oil ; Contract Size, 1, Barrels (42, Gallons) ; Notional Contract Value, 1, x Price ; Trading. The last, change, open, high, low and previous close for each Crude Oil WTI Futures Future contract. The Exchange may impose limits on positions in this contract at its discretion in accordance with Exchange Rule P3. Current expiry limit: 7, contracts in. Current West Texas Intermediate Crude Oil (WTI) Prices ; 06/25/24, $ ; 06/24/24, $ ; 06/21/24, $ ; 06/20/24, $ Crude oil futures are standardized exchange-traded contracts that represent 1, barrels of crude oil (standard contract) or barrels of crude oil (Micro. (Crude Oil in Dollars per Barrel, All Others in Dollars per Gallon). Period Notes: Official daily closing prices at p.m. from the trading floor. Get the latest Crude Oil price (CL:NMX) as well as the latest futures prices and other commodity market news at Nasdaq. Futures Overview ; Crude Oil Continuous Contract, $, , % ; Brent Crude Oil Continuous Contract, $, , %. Crude oil futures can fluctuate based on the geopolitical environment. In recent years, CME Group has introduced the mini crude oil futures contract and the. Traditionally, you'd trade crude oil futures if you were an oil producer or used oil as an industry input. The contracts remove uncertainty the from future. NYMEX Crude Oil Asian shares and global stock futures fell on Wednesday in the wake of a tech selloff, while the dollar and yen rose on safety bids and U.S. Oil Price Charts ; WTI Crude, , , % · (55 Minutes Delay) ; Brent Crude, , , % · (55 Minutes Delay) ; Murban Crude, , , %. Get updated data about energy and oil prices. Find natural gas, emissions, and crude oil price changes %Change, Contract, Time (EDT). CL1:COM. WTI Crude. WTI Crude Oil e (NYMEX) ; Tick Size: $ (1c) per barrel ($10 per contract) ; Quoted Units: US $ per barrel ; Initial Margin: $9, Maint Margin: $7, Brent decreased USD/BBL or % since the beginning of , according to trading on a contract for difference (CFD) that tracks the benchmark market. The ICE West Texas Intermediate (WTI) Light Sweet Crude Oil Futures Contract offers participants the opportunity to trade one of the world's most liquid oil. price, news, historical charts, analyst ratings and Commodities & Futures: Futures prices are delayed at least 10 minutes as per exchange requirements.

Check If My Car Has Warranty

Check the Status of Your Warranties · 1. Go to medicinetizer.ru · 3. Sign in to My Account. · 4. Select the account icon again and choose Account from the pull-. Check if your vehicle has an open recall. Q&As. If I sell my car, does the new vehicle limited warranty transfer to the new owner? Yes. If the limited. Call the service department of the make of the vehicle. Have the digit VIN available, and the current mileage. They will tell you if it is still under. Is Nissan Warranty Transferable? Nissan warranties are generally transferable from the original owner to other subsequent owners of the vehicle without any. After expiration, the Used Vehicle Limited Warranty provides additional coverage of 1 year or 10, miles. If the Basic Vehicle Limited Warranty has already. To help keep you sailing smooth, your vehicle's warranty* is along for the ride. In addition, if your vehicle fails a smog check inspection, FCA US LLC will. Getting the VIN and calling a dealer service department to ask is the only answer. Warranties actually do get cancelled sometimes and that is. Warranties. Included with Genuine GM Parts. Recalls. Check if your vehicle has an open recall. Q&As. If I sell my car, do the warranties transfer to the new. If you cannot find the VIN number, the only real way to check your vehicle's factory warranty is to call or visit your local dealership. They will need the VIN. Check the Status of Your Warranties · 1. Go to medicinetizer.ru · 3. Sign in to My Account. · 4. Select the account icon again and choose Account from the pull-. Check if your vehicle has an open recall. Q&As. If I sell my car, does the new vehicle limited warranty transfer to the new owner? Yes. If the limited. Call the service department of the make of the vehicle. Have the digit VIN available, and the current mileage. They will tell you if it is still under. Is Nissan Warranty Transferable? Nissan warranties are generally transferable from the original owner to other subsequent owners of the vehicle without any. After expiration, the Used Vehicle Limited Warranty provides additional coverage of 1 year or 10, miles. If the Basic Vehicle Limited Warranty has already. To help keep you sailing smooth, your vehicle's warranty* is along for the ride. In addition, if your vehicle fails a smog check inspection, FCA US LLC will. Getting the VIN and calling a dealer service department to ask is the only answer. Warranties actually do get cancelled sometimes and that is. Warranties. Included with Genuine GM Parts. Recalls. Check if your vehicle has an open recall. Q&As. If I sell my car, do the warranties transfer to the new. If you cannot find the VIN number, the only real way to check your vehicle's factory warranty is to call or visit your local dealership. They will need the VIN.

Every new Ford vehicle comes with a New Vehicle Limited Warranty. You can check your warranty status by submitting your Vehicles Identification Number (VIN) or. Look up the details of all your vehicle's warranties through Mopar Vehicle Resources. Sign in to the Mopar Owners Site to find information on your vehicle. Every new Ford vehicle comes with a New Vehicle Limited Warranty. You can check your warranty status by submitting your Vehicle's Identification Number (VIN). Check if your vehicle has an open recall.. Q&As. If I sell my car, does the new vehicle limited warranty transfer to the new owner? Yes. Those limited. The surefire way to find if your car is under warranty is to enter the VIN on your manufacturer's website or give it to a dealer. If you want to cover your car. If a car is covered by the state's used car warranty law or another warranty, then the dealer must check the “dealer warranty” box on the Buyers Guide. The. In addition, if your vehicle fails a smog check This warranty may be restricted or denied if your vehicle or part has been modified, improperly maintained or. Check the warranty paperwork: The easiest way to know if a car warranty is still active is by checking the warranty paperwork that came with the car. The. This page has an error. You might just need to refresh it. [Cannot read Enter your VIN to access warranty information for your vehicle. VIN NUMBER. To check if your vehicle is still covered under the manufacturer's warranty, you will need to find your VIN, check your odometer, and find out the year the. To check if your vehicle is still covered under the manufacturer's warranty, you will need to find your VIN, check your odometer, and find out the year the. Perhaps the simplest way to check to see if your used car is under warranty is to use a service such as Carfax. You can go their website, and enter your VIN. Motorcheck reports will tell you if a car is still under warranty, so you can have peace of mind when buying a new car. Run your check today! What is my current BMW warranty and/or BMW service or maintenance program coverage? When does it expire? · 1. Open the My BMW App · 2. Choose the car/shopping bag. The factory coverage warranty period begins on the vehicle's in-service date, which is the first date the vehicle is either delivered to the original. Your car's owner's manual will provide details on the warranty coverage from the time it was initially sold. To find the mileage, check the odometer. If the. Input your Vehicle Identification Number to verify if your vehicle qualifies for this extended warranty. Hyundai is. Yes of course. Warranty is always an important consideration when purchasing a used vehicle. This is why Motorcheck provides manufacturer warranty. Locate and write down your VIN number. This is the unique, character code comprised of letters and numbers that identifies your specific vehicle. · Check your. Read Your Warranty Carefully: First things first, check the details of your warranty. · Talk to the Dealer: Sometimes a little communication can.

Dividend Taxable

A dividend on corporate stock is taxable when it is unqualifiedly made subject to the demand of the shareholder. Capital gains do not include ordinary income, such as interest or dividend income. Although qualified dividends are taxed at long-term capital gains rates under. Get information on how dividend income is taxed, including the dividend tax rate and treatment of qualified dividends. Connecticut full-year residents and part-year residents may be liable to pay a state tax on capital gains, dividends and interest income. Different from dividend income and capital gains distributions, return of capital distributions are currently non-taxable to shareholders, unless the. The profits and losses pass through to the owners' personal tax returns. This method avoids double taxation. Shareholders must report dividend payments on their. If your taxable interest income is more than $1, or you received interest as a nominee for the real owner, you must also include that income on Schedule B . The Permanent Fund Dividend (PFD) amount is $1, The state's Federal Tax Identification number is The PFD Division's mailing address. The tax rate is 5% for taxable periods ending before December 31, For taxable periods ending on or after December 31, , the tax rate is 4%, and for. A dividend on corporate stock is taxable when it is unqualifiedly made subject to the demand of the shareholder. Capital gains do not include ordinary income, such as interest or dividend income. Although qualified dividends are taxed at long-term capital gains rates under. Get information on how dividend income is taxed, including the dividend tax rate and treatment of qualified dividends. Connecticut full-year residents and part-year residents may be liable to pay a state tax on capital gains, dividends and interest income. Different from dividend income and capital gains distributions, return of capital distributions are currently non-taxable to shareholders, unless the. The profits and losses pass through to the owners' personal tax returns. This method avoids double taxation. Shareholders must report dividend payments on their. If your taxable interest income is more than $1, or you received interest as a nominee for the real owner, you must also include that income on Schedule B . The Permanent Fund Dividend (PFD) amount is $1, The state's Federal Tax Identification number is The PFD Division's mailing address. The tax rate is 5% for taxable periods ending before December 31, For taxable periods ending on or after December 31, , the tax rate is 4%, and for.

For. Pennsylvania personal income tax purposes, nonresidents are not taxed on dividends from Pennsylvania sources. Dividends are ignored by the nonresident. File with H&R Block to get your max refund · In the 10% or 12% tax bracket, your qualified dividends are taxed at 0%, · In the 22%, 24%, 32%, or 35% tax bracket. Qualified dividends, as defined by the United States Internal Revenue Code, are ordinary dividends that meet specific criteria to be taxed at the lower. The extent to which distributions made by FirstEnergy Corp. (“FE”) to its shareholders are taxable as a dividend for U.S. federal income tax purposes is. Certain dividends known as qualified dividends are subject to the same tax rates as long-term capital gains, which are lower than rates for ordinary income. tax return for the same taxable year. Return filing and extensions. The Timber, timberlands, and dividends and distributions from real estate. Tax-Advantaged Global Dividend Income Fund · 1. Distribution Rate at NAV and Market Price is calculated by dividing the last distribution paid per share . Return Of Capital Tax Information. A corporation's quarterly distribution of cash is characterized as a taxable dividend (qualified dividend) to the extent it. Dividend income is a distribution of earnings paid to shareholders. Learn about dividend income, its tax implications, and the DIV form. You only pay tax on any dividend income above the dividend allowance. You do not pay tax on dividends from shares in an ISA. Qualified dividends are taxed at the same rates as the capital gains tax rate. These rates are lower than ordinary income tax rates. However, "ordinary dividends" (or "nonqualified dividends") are taxed at your normal marginal tax rate. Subscribe to Kiplinger's Personal Finance. Be a smarter. Interest and dividend income from U.S. government obligations is subject to federal income tax but is exempt from state income tax by federal law. This includes. A dividend tax is a tax imposed by a jurisdiction on dividends paid by a corporation to its shareholders (stockholders). The primary tax liability is that. Tax-Advantaged Dividend Income Fund ; Total Net Assets, $B ; CUSIP, G ; Management Fees, ; Other Expenses, ; Total Expenses (ex Interest and Fee. Dashboard information for the Interest & Dividends Tax. Whereas, non-qualified or 'ordinary' dividends are taxed at the less favorable ordinary income tax rates, which can reach a staggering 37%. Obviously. Dividend tax. Companies can distribute some of their profits as dividend to their shareholders. Dividends are subject to tax. The general rate of dividend tax. Dividend Income on Form DIV: Are Dividends Taxable? What Is the Tax Rate or Ordinary and Qualified Dividends? Find Out the Details. Because the dividend is income, you'll owe taxes on that amount (if you invest in a taxable account). Think about dividends before investing a large amount.